Unleaded is produced from crude oil, and as global crude oil prices fluctuate, this impacts the pump price. However, the unleaded product’s cost only makes up 36% of the price you pay at the pump. So, where do the extra costs come from?

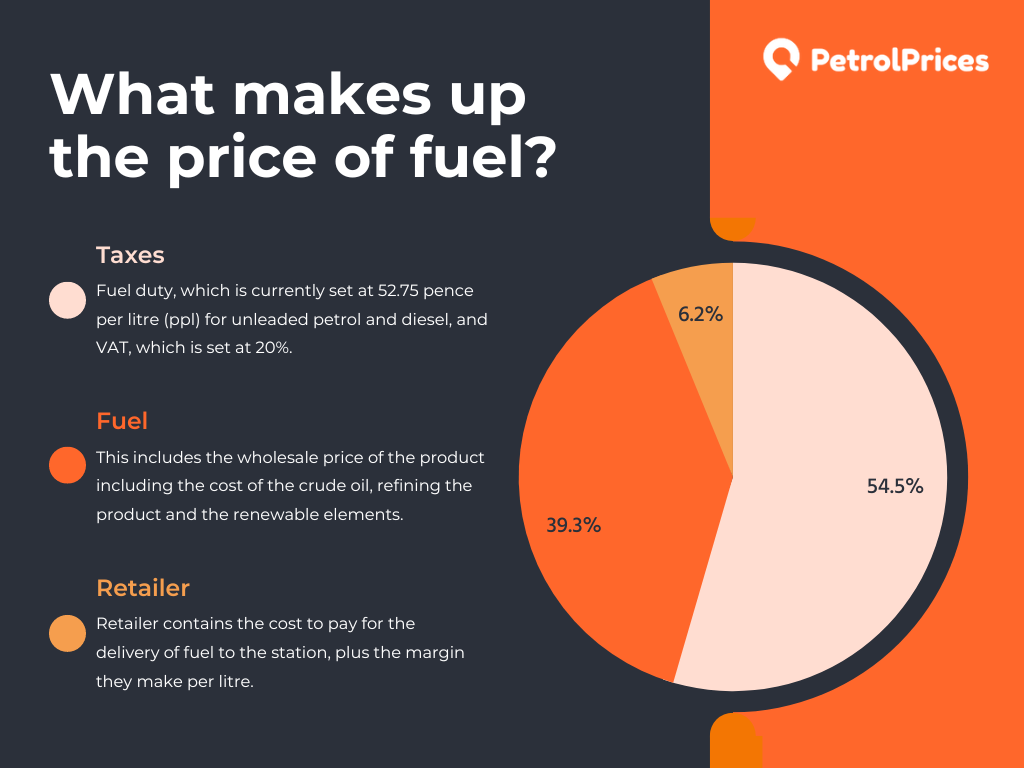

Maybe unsurprisingly, it’s tax. The majority of the pump price is made up from two taxes. Fuel duty, which is currently set at 52.75 pence per litre (ppl) for unleaded petrol and diesel, and VAT, which is set at 20%. Fuel duty was reduced from 57.95ppl to its current value in March 2022, and this change was intended to reduce the cost of fuel to support households and businesses at a time of very high oil prices. Motorists also pay 20% VAT on top of the total cost of the fuel, including the fuel duty, which means that the 52.75ppl fuel duty is actually 63.3ppl at the pump. Over 54% of the price of unleaded and over 52% of the diesel cost at the pump is tax.

The unleaded that you put in your vehicle is a blend of crude oil derived fuel and ethanol, and in diesel, biodiesel is blended at up to 7%. The renewable part of the fuels makes up around 2% of the total cost.

There is also a cost to move the fuel from the refinery and terminals around the UK into the petrol stations. This is typically less than 1% of the total cost of fuel.

The remaining cost is the retailer’s margin, which is usually around 5-7% of the total cost of fuel.

SHOCKING

Nothing but greedy sods,in Australia it’s just over £1per litre for petrol. 😡😡😡