On Monday, 3rd July, the Competition and Markets Authority (CMA) published its road fuel market study.

The report focused on the supply chain and found “problems in relation to three aspects of the retail market.”

Asda, which was historically the market leader in terms of low pricing, was found to have decided to achieve higher margins in 2022. This was brought about by reducing prices “more slowly than would previously have been the case.”

Morrisons is also named as historically having a more aggressive pricing approach.

Tesco and Sainsbury’s were found to have “largely passive pricing policies,” whereby they set prices based on local competitors rather than cost movements. This meant that Asda did not drop their prices, and neither did Tesco or Sainsbury’s.

This change resulted in the headline figure of motorists paying 6 pence per litre more for unleaded petrol, or a combined £900m. Diesel prices were hit even harder, with an average of more than 13ppl from January to May 2023.

According to the CMA report, supermarket margins increased from 4.6ppl in 2019 to 10.8ppl in 2022. At the same time, large non-supermarket margins rose from 6.8ppl to 10.3ppl during the same period.

Asda’s Pricing Strategy

We at PetrolPrices, wanted to look further into Asda’s pricing strategies and what has happened to the retail fuel market.

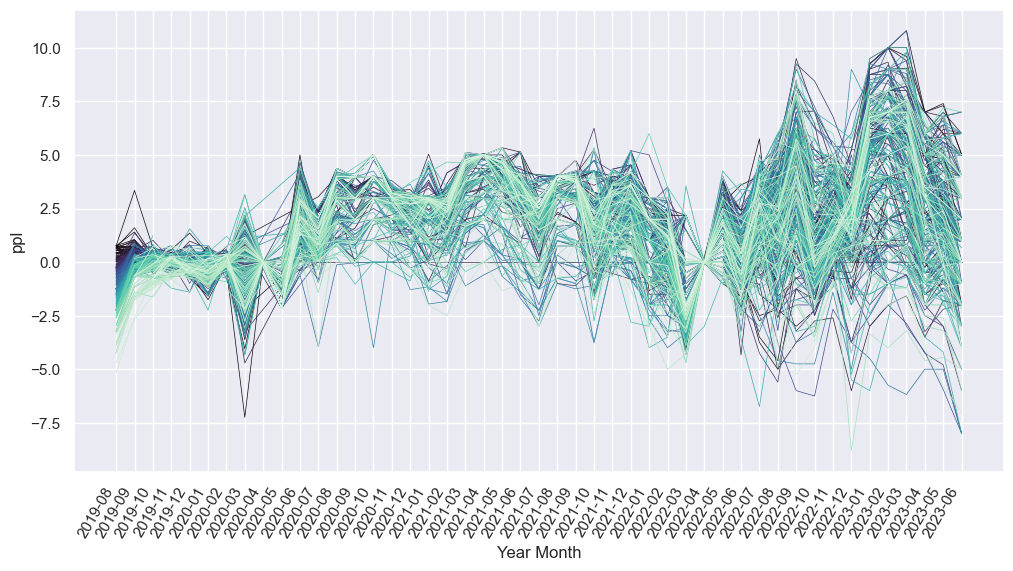

The CMA found that as prices fell, retailers did not pass the drop on to motorists and looked to increase their margins. However, this was at a national level. We looked at how Asda was pricing against other Asda sites. This comparison used Asda Bolton as a benchmark and compared all other Asda prices against it.

By comparing Asda sites against each other, you are removing global pricing factors, such as exchange rates, crude prices, wholesale diesel and unleaded prices. Local outages or transport issues may explain why a site in one area may become more expensive.

This chart shows that between August 2019 and May 2020, Asda priced relatively consistently across the UK, which means that no matter which Asda you visited, you would pay the same or comparable price. In April 2020, this was particularly true, where prices were nearly all identical.

From June 2020 to April 2022, prices spread more widely across the Asda sites. Note that this isn’t showing an increase in price but an increase in price against our benchmark, Asda Bolton, which became one of the cheaper Asda’s during this time.

April 2022 is again an interesting point on this timeline. Prices were nearly exclusively 158.7ppl and then 160.7ppl during this time.

From May 2022 onwards, there appears to be a shift in pricing strategy with a much wider spread of prices across the Asda sites. There is more than a 15ppl spread across Asda locations from May 2022. This isn’t because of global pricing factors or exchange rates.

Asda has changed its strategy; from a relatively consistent national pricing structure to significant variations across the country. And remember, the CMA found that Tesco and Sainsbury’s were passive during this period, meaning they used Asda as a guide to price their sites. Any change in pricing strategy or margin increase that was seen on Asda forecourts, was also seen across all the supermarkets, and in the other retailers.

The market has not performed as it should. Supermarkets have 44% of the road fuel market (2021). The CMA’s report notes that other retailers, including Tesco and Sainsbury’s, did not respond promptly to cost movements and/or try to win market share. The report suggested, “Asda and Morrisons have been able to keep their market share broadly stable across this period.” Asda increased prices due to a lack of price competition from others.

The proposed solution from the CMA is for more market transparency. We agree this is a good thing. But it is no silver bullet. And will it stop this type of thing from happening again? It is being branded as a new idea for the UK, but one that is available in Germany and Australia. Still, fuel comparison platforms such as PetrolPrices are already available in the UK.

To read more about fuel price data in the UK you can do so here, at our Latest Fuel Price Data analysis page.

Does this go far enough? Let us know your thoughts in the comments.

At PetrolPrices we are working and have been since 2005 on offering a more transparent fuel market. We continue to invest in the app and have recently added the Search Here button, making finding prices across the UK even easier. So, if you haven’t got the latest version, please check out the Play Store or App Store. Thank you to everyone that has added a price or written a review. We hope you continue to find value in the information provided within our app and website.

Surely it’s no coincidence that the folk who already owned Euro Garages took over Asda last year.

We have 2 garages in our village. They always matched each other. One was recently taken over by Euro garages and they now charge 4p more than the other. No surprise then that Euro garages own Asda.

Strange that one independent service station in Wolverhampton can consistently sell unleaded for £130.6 and Sainsbury’s, and Asda can near match the same price. What about the rest of their branches, some as high as £1.51.9!

We were living in Bude and prices have been high for a long time and very slow coming down.

The change in ownership is surely the cause of the change in strategy. Down to one thing – profiteering. Are they doing the same with groceries? In my opinion CMA need to be far more aggressive with ALL the supermarkets. Interestingly I am in London at the moment and Tesco at Old Kent Rd diesel is 1p cheaper than petrol!! £1.48 & £1.49

Thank you PetrolPrices.

My local Costco has consistently been charging 10-15 ppl LESS than the local Asda, Tesco, Sainsbury’s etc. Currently, diesel is £1.34 pl, the next cheapest in Southampton is Tesco at £1.46 pl. If Costco can charge this, why can’t the supermarkets? We are definitely being ripped off

Until they start dropping there price l will no longer use Asda if l don’t get petrol l don’t shop

I

Issa brothers need all that extra revenue to fund their vanity projects in Blackburn.

Incidentally, Asda Bolton is consistently 5ppl cheaper minimum than Asda Blackburn

Most filling stations are still acting as a cabal!! including the supermarkets, although Morrison’s has been a few pence dearer but if you shop and spend £30 on groceries you get 5p per Ltr off at the pump, in my area when Total puts up the price the rest of the brands including Shell and Total Energies follow suit, the Total Energies brand (French) it is said are still selling Russian petrol

Such a shame that Euro Garages were allowed to make that hugely over leveraged acquisition. Now they have an ocean of debt to service and need to milk the market. Should never have been allowed

Spot on. A smoke and mirrors job.

Called in Morrisons today diesel at £138.7, Jet was £148.9 and the BP was 151.9.

The queue was at Morrisons.

I think it’s about time the amount of duty and tax and the actual market cost of the fuel should be on the pumps. Then we would all know how the end user is being ripped off every time we fill up.

Our local ASDA is 7p dearer than another ASDA 4 miles away, when the manager was asked why it is, he said there is no competion, I think basically its shocking. Between the two, our local one has always been dearer than the other.

Does not make sense as Dunfermline asda is closer to the fuel refinery in Grangemouth than Kirkcaldy asda which strangely is almost 10p a ltr cheaper